Published: August 2018

Author: Bank of England Mortgage Staff

As mortgage rates rise, I am commonly asked, “Has business slowed down?” While business has NOT slowed down, it does beg the question, “What impact does higher interest rates have on buying behaviors?” Let’s examine this for a few minutes.

In 2003, a nationally recognized articled explained the top five reasons for refinancing were the following:

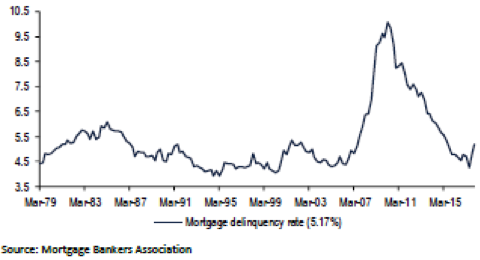

15 years later, I don’t think these loan purposes (driving the refinance market) have changed much. Interestingly, interest rate was/is not a driver. Interest rate is a component of the refinancing process that impacts overall affordability of the transaction. Today, speaking from my own experiences, debt consolidation loans are significantly less than 15 years ago, despite dramatic gains in home equity over the past 5 to 6 years. Today’s regulatory framework limits mortgage product development and creativity; which has kept the industry in check compared to the escalating demand with the former subprime market. Additionally, if the recession taught us anything, consumer accountability with personal finances has improved dramatically. And as we experience positive economic times, mortgage credit and performance risk is lower, as illustrated in the following image.

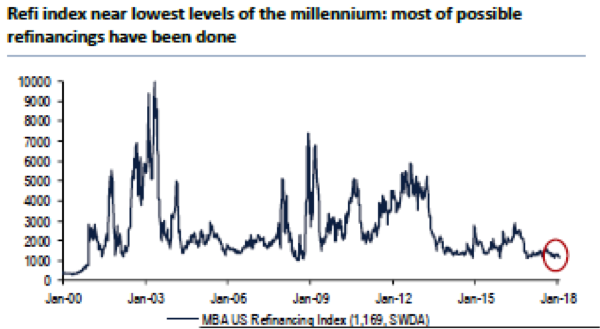

In the grand scheme of things, refinance activity is the lowest it’s been in 15+ years, as illustrated below. Refinance activity was actually higher when rates were higher. In years 2002-2013, much of that refinance activity was fueled by high consumer debt obligations, steep gains in equity, and the evolution and collapse of the mortgage subprime market.

So what impact does mortgage rates have on home purchase activity? During strong economic times, purchase activity is fueled largely by economic components and the supply/demand of housing. For example, business relocation, job expansion and growth causes movement that dictates new purchase behaviors (i.e. customer moves from one location to another location for a promotion). In this case, positive economic trends drive the purchase behavior, not rate. (One could argue that low rates drive economic purchase behaviors but we’ll save that debate for another day).

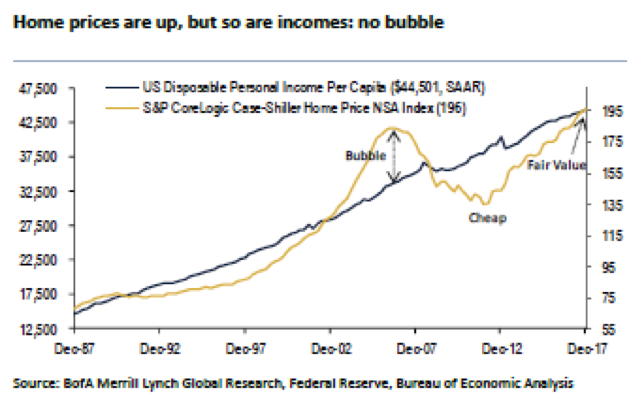

Furthermore, as the graph below illustrates, there is no bubble between home prices and personal incomes. While rising interest rates will definitely impact affordability, personal incomes remain very strong and should withstand higher mortgage payments.

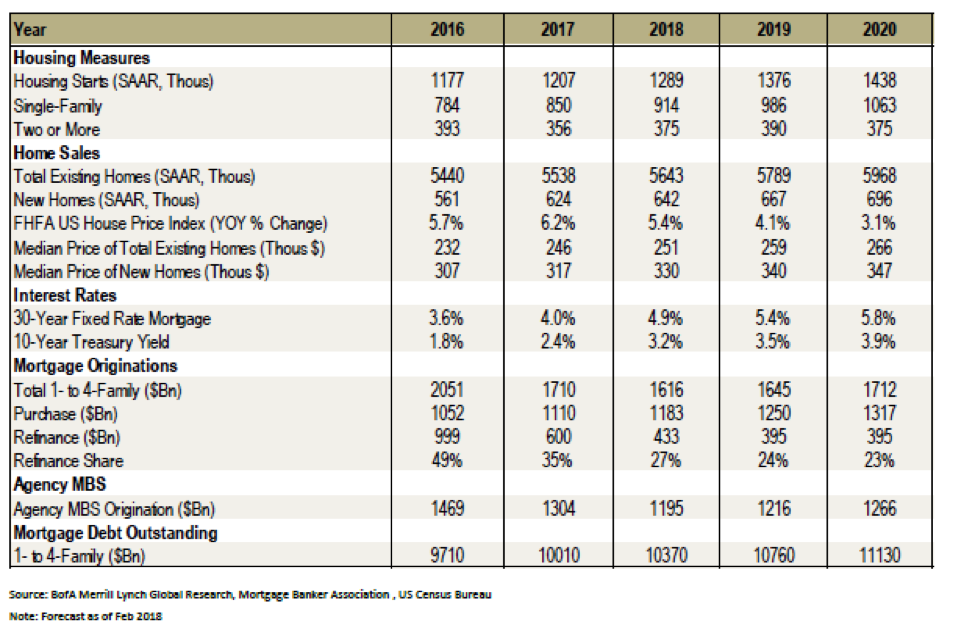

For entertainment purposes, I’ll include some MBA forecasts for the near future. I hesitate to include this, as I can show presentations from 2013, 2014, etc., that attempt to predict rising interest rates that never happened. But now that rates have increased, perhaps the MBA forecasts will be more foretelling than in years’ past. Recognizing that most my reading audience is within the lending and banking communities, you can expect a flat forecast with little to modest growth. And these forecasts take into consideration continued rising interest rates. By 2020, we’ll be near a 6% 30-year market. Or will we? Get out your crystal ball.